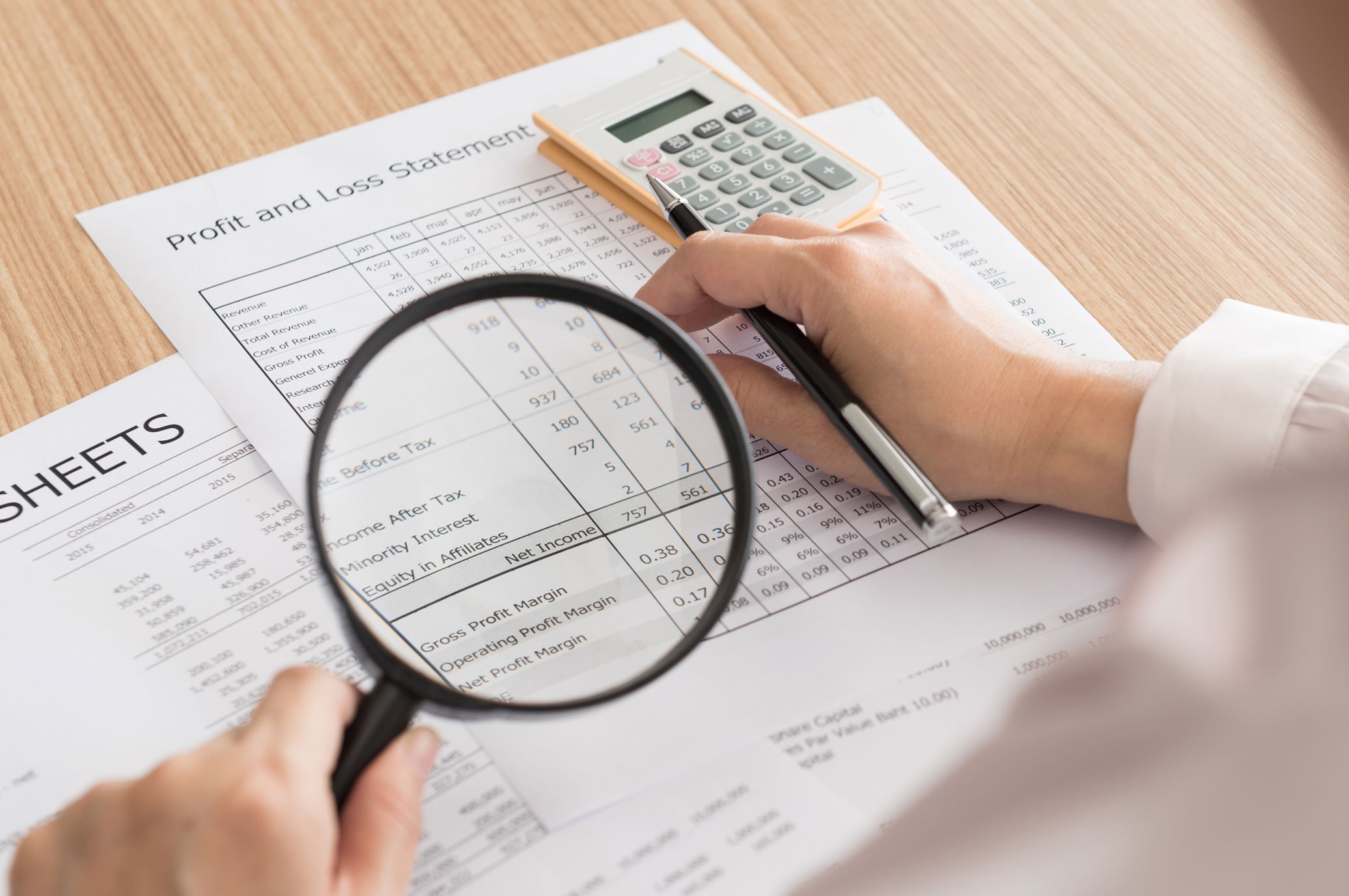

What are accounts receivable? Accounts receivable (AR) are funds that a customer owes a business for goods or services provided on credit. An accounts receivable audit evaluates the accuracy and completeness of financial records relating to outstanding invoices. Regular audits help businesses keep track of their money and ensure customers are paying their dues in a timely manner. Here’s how to audit accounts receivable.

Step 1: Gather All Necessary Documentation

The first step in auditing accounts receivable is to gather all necessary documents such as customer invoices, sales orders, cash receipts, account statements, and collection letters. By having this information readily available, you will be able to perform your audit more efficiently.

Step 2: Separate Uncollectable Items

Once you have gathered all the required documentation, it’s time to separate uncollectable items from collectible ones. This means separating out any invoices that cannot be collected due to payment disputes or lack of payment from those that can be collected immediately or soon thereafter. Doing this helps the auditor easily identify any discrepancies in payments received versus payments expected based on customer records.

Step 3: Analyze Payment History

Next, it’s important to analyze each customer’s payment history over the past few months or years depending on how long they’ve been doing business with your company. This includes looking at when payments were made, how much was paid each time, and if there have been any late payments or missed payments throughout the duration of their relationship with your company.

Step 4: Compare Customer Records With Bank Statements

To ensure accuracy it’s also important to compare customer records with bank statements when conducting an audit of accounts receivable. This means matching up any deposits made by customers against what is recorded in the system for each individual transaction so that if there are any discrepancies, they can be addressed promptly before false data enters into the system permanently affecting accounting data down the line.

Step 5: Check Outstanding Invoices For Discrepancies

Finally, it’s important to check outstanding invoices for discrepancies between what has been invoiced and what has actually been paid by customers during the period under review. This process may involve going through each invoice individually and ensuring that no unauthorized adjustments have been made, as well as checking that post-dated cheques are still valid and haven’t expired without being paid. Either way, another discrepancy may arise that needs to be addressed quickly before moving on to other elements within an AR audit process.

Tips to make accounts receivable auditing easier

– Use automation wherever possible as it helps to streamline processes significantly, saving time and energy, while also drastically reducing human error!

– Always double-check all entries against both external sources such as bank statements and internal sources such as customer files, etc. so that everything remains accurate & correct at every level of its existence within an organization/institution/company, etc.

– Consider implementing advanced technologies such as AI/ML-powered analytics tools that provide real-time insights into AR performance and quickly identify anomalies, helping to ensure that issues don’t get out of hand before they can even be noticed, let alone properly addressed!

– Communicate regularly with customers about their current balances and upcoming due dates so everyone is on top of things and nothing is accidentally overlooked, leading to potential delays/issues down the line – this also goes hand in hand with maintaining good relationships, as people appreciate knowing where things stand proactively, rather than waiting until the last minute and then retroactively trying to catch up afterward!